PART 3: Samsung TV Plus, LG Channels & Emerging Platforms

Samsung TV Plus, LG Channels & Emerging Platforms: Technical Specifications for Complete FAST Distribution

Samsung TV Plus and LG Channels represent the next tier of essential FAST distribution beyond Roku and Fire TV, collectively reaching more than 150 million active devices globally (https://news.samsung.com/us/samsung-tv-plus-unveils-global-fast-platform-premium-content-exclusive-premieres-key-partnerships/). These manufacturer-integrated platforms offer unique advantages—pre-installation on every compatible television means zero friction between device ownership and channel discovery. Publishers who dismiss these platforms as secondary distribution channels consistently underestimate their monetisation potential and growth trajectories.

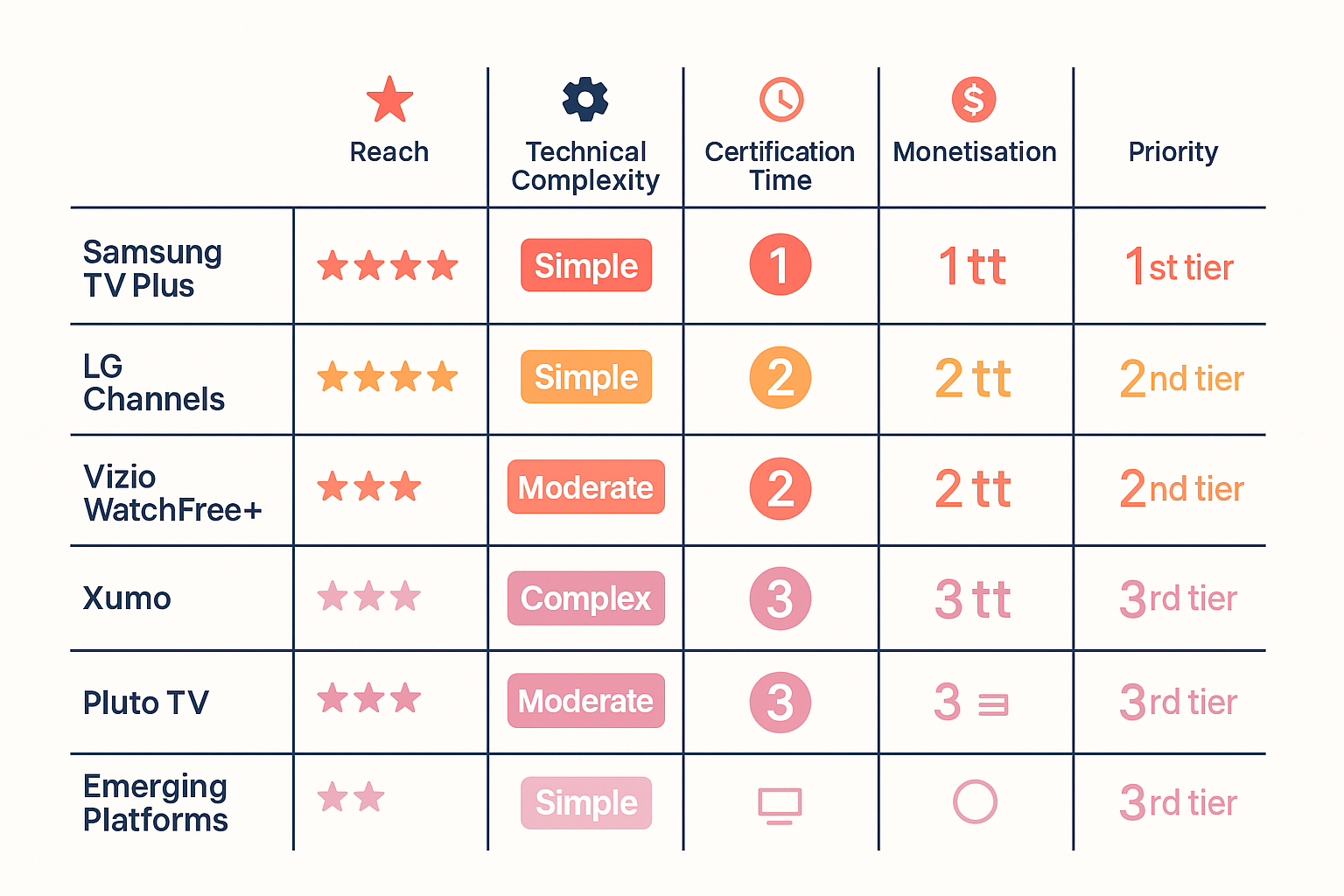

Beyond Samsung and LG, emerging platforms like Vizio WatchFree+, Xumo, Pluto TV, and regional international services continue fragmenting the FAST landscape. Smart distribution strategy requires understanding which platforms deserve immediate attention versus which can wait for channel maturity. Technical specifications across these platforms share common foundations whilst implementing unique requirements that impact development complexity and maintenance burden.

Samsung TV Plus: The Global FAST Leader

Samsung TV Plus has grown into the world’s largest FAST platform by channel count, offering nearly 700 channels in the United States and over 3,500 channels globally across 24 countries (https://www.purevpn.com/blog/samsung-tv-plus-channels-list/). The platform achieved 88 million monthly active users as of 2025, representing 30% year-over-year growth in engagement (https://vodlix.com/blog/samsung-tv-plus-guide/). These numbers matter—Samsung TV Plus transforms from “optional additional distribution” to “mandatory platform” when you consider its scale and viewer engagement metrics.

The technical foundation centres on Samsung’s Tizen operating system specifications (https://developer.samsung.com/smarttv/develop/specifications/media-specifications/2025-tv-video-specifications.html). The 2025 TV models support H.264, H.265/HEVC, VP8, VP9, and AV1 codecs, though H.264 and HEVC provide the most reliable compatibility across Samsung’s device ecosystem. Maximum resolution support varies by device tier—8K models handle up to 7680×4320 whilst UHD models support 3840×2160 as their ceiling.

Critical technical note: DTS Audio codec support ended on 2025 Samsung TV models. Any content encoded with DTS audio tracks will fail playback on current-generation televisions. Publishers must verify their audio implementation uses AAC or Dolby formats exclusively—discovering DTS compatibility issues after platform approval creates painful re-encoding work across your entire content library.

Samsung’s Ad Integration and Monetisation

Samsung TV Plus operates its own advertising technology stack, Samsung Ads, which provides unique targeting capabilities based on Samsung’s automatic content recognition (ACR) technology (https://samsungads.com/resources/). This first-party data enables more precise audience targeting than generic VAST implementations, typically yielding 15-30% higher CPMs compared to standard programmatic fills. Publishers must integrate Samsung’s specific advertising APIs to access this premium demand—standard VAST tags alone sacrifice significant revenue opportunity.

The platform’s ad load recommendations balance viewer experience against monetisation goals. Samsung suggests ad breaks every 8-12 minutes for long-form content, with individual breaks containing 2-4 ad spots maximum. These constraints prove less restrictive than traditional television’s 4-5 minutes of ads per 30-minute programming block, but more structured than some FAST platforms that allow publishers complete ad load control.

Server-side ad insertion integration with Samsung’s platform requires specific implementation patterns that differ from other FAST platforms. The technical documentation provides detailed API specifications, but publishers should allocate development resources specifically for Samsung integration—attempting to use generic SSAI implementations creates complications that delay launch and compromise ad delivery reliability.

LG Channels: The Challenger Platform

LG Channels serves as LG Electronics’ answer to Samsung TV Plus, pre-installed on LG Smart TVs running WebOS 3.0 and later (https://www.lg.com/us/support/help-library/lg-channels-overview-CT32804032-20152736387480). The platform’s reach trails Samsung’s global presence but represents meaningful distribution, particularly in North America and Europe where LG maintains strong market share. LG’s premium television positioning creates an audience skew towards higher household incomes, potentially justifying the development investment despite smaller absolute viewership numbers.

WebOS technical specifications share similarities with other platforms whilst implementing unique requirements. The platform supports H.264 and HEVC video codecs with HLS delivery as the preferred streaming protocol. LG’s technical documentation recommends adaptive bitrate implementations with at least 4 quality variants, matching industry standards. However, LG devices exhibit particular sensitivity to improper segment alignment and IDR frame placement—technical issues that other platforms handle gracefully cause playback failures on LG hardware.

LG’s certification process emphasises content quality and brand safety more heavily than pure technical compliance. The platform reviews channels for content appropriateness, advertising standards, and brand alignment with LG’s premium positioning. This curation creates higher approval barriers than platforms with more open submission processes, but results in less content competition and potentially better viewer attention for approved channels.

Vizio WatchFree+: The Growing Alternative

Vizio WatchFree+ leverages Vizio’s significant North American television market share, particularly in the budget-to-midrange price segments (https://www.vizio.com/watchfreeplus). The platform’s technical requirements align closely with industry standards—H.264 video codec, HLS delivery, VAST advertising—making it relatively straightforward for publishers already distributing on major platforms. Vizio’s lower technical barriers and faster certification compared to Samsung or LG make it attractive for publishers seeking quick additional distribution.

WatchFree+ differentiation comes from Vizio’s SmartCast platform integration and Vizio’s Inscape ACR technology. Like Samsung, Vizio’s first-party viewership data enables sophisticated advertising targeting that commands premium CPMs. Publishers who dismiss Vizio as merely “another streaming platform” miss the monetisation advantages that platform-specific advertising integration provides.

The certification timeline typically runs 2-4 weeks for technically compliant channels, faster than Samsung’s more rigorous review process. Vizio’s relatively open approach to content partnerships creates opportunities for newer publishers to gain platform experience before tackling more demanding certification processes on larger platforms.

Xumo: The Comcast-Backed Platform

Xumo represents Comcast’s strategic entry into the FAST ecosystem, combining over-the-air broadcast channels with on-demand streaming content (https://www.xumo.com/). Comcast’s distribution through its own devices plus partnerships with other manufacturers provides meaningful reach, particularly as cable providers increasingly position themselves as aggregators rather than pure content distributors. Xumo’s technical specifications follow industry standards with few unique requirements, making it accessible for publishers with existing FAST implementations.

The platform’s integration with Comcast’s advertising technology provides scale advantages, particularly for publishers seeking programmatic advertising demand. Xumo’s ad decisioning systems tie into Comcast’s FreeWheel ad serving platform, accessing demand from major brands running campaigns across Comcast’s properties. This integration typically yields competitive CPMs whilst maintaining reasonable ad load standards that don’t compromise viewer experience.

Xumo’s channel approval process emphasises content quality and programming consistency over technical perfection. The platform seeks channels that maintain regular update schedules and provide reliable content flow rather than sporadic uploads or inconsistent programming. Publishers with established content libraries and regular production schedules find Xumo’s approval process straightforward.

Pluto TV: The Paramount Global Giant

Pluto TV predates most FAST platforms, launching in 2013 and gaining substantial momentum following Paramount Global’s acquisition (https://pluto.tv/). The platform’s massive channel count and extensive international distribution create enormous potential reach, though the crowded channel lineup also creates discovery challenges. Publishers should view Pluto TV as essential distribution despite increasingly competitive positioning—the platform’s viewership numbers justify inclusion in any comprehensive FAST strategy.

Technical requirements align with industry standards: H.264 video codec, HLS delivery, standard VAST advertising implementation. Pluto TV’s maturity as a platform means robust documentation, established certification processes, and technical support resources that newer platforms haven’t yet developed. Publishers experience fewer technical surprises with Pluto TV compared to emerging platforms still refining their implementation requirements.

The platform’s extensive channel library creates unique programming challenges. Pluto TV viewers expect dozens or hundreds of channel options, making individual channel discovery dependent on Pluto TV’s recommendation algorithms and category placement. Publishers must optimise metadata extensively and maintain consistent programming schedules to capture algorithmic promotion—channels that go dark for extended periods get buried in search results and category listings.

Regional and International Platform Considerations

FAST platforms increasingly fragment along regional and linguistic lines, creating both opportunities and complexity for publishers with international content or global ambitions. Rakuten TV in Europe, 9Now in Australia, and numerous country-specific platforms provide valuable distribution for regionally relevant content. However, each additional platform adds maintenance overhead—technical specifications, content compliance, advertising integration, and reporting all require ongoing attention.

The business case for international platform expansion depends entirely on your content’s geographic relevance and localisation capabilities. Publishers with English-language content face easier international distribution than those requiring subtitling or dubbing for foreign markets. Similarly, content with cultural specificity (local news, regional sports, country-specific entertainment) faces distribution challenges on global platforms whilst excelling on regional services.

Technical requirements for international platforms generally mirror North American standards—H.264/HEVC codecs, HLS delivery, VAST advertising—though specific bitrate recommendations may differ based on regional internet infrastructure. European platforms sometimes recommend lower bitrates than US platforms, reflecting differences in broadband penetration and connection speeds. Research each target platform’s technical recommendations rather than assuming universal specifications.

Platform Prioritisation Strategy

Smart platform expansion follows viewer concentration and monetisation potential rather than simply pursuing every available distribution opportunity. Roku and Fire TV demand immediate priority for North American publishers due to their dominant market share and robust advertising ecosystems. Samsung TV Plus represents the clear third priority given its massive global reach and growing advertising capabilities.

LG Channels, Vizio WatchFree+, and Xumo form the second tier—meaningful distribution that justifies development investment once major platforms are operational. These platforms provide incremental viewership growth without requiring dramatically different technical implementations from your Roku/Fire TV foundation. Publishers should batch these secondary platform launches to amortise development and testing efforts across multiple submissions.

Pluto TV’s prioritisation depends on competitive intensity within your genre. Channels in crowded categories face discovery challenges that may not justify Pluto TV’s development investment, whilst niche content with limited competition can achieve strong performance. Evaluate Pluto TV’s existing channel lineup in your category before committing resources to platform integration.

Emerging platforms and international services should wait until your channel demonstrates traction on major platforms. Early-stage channels benefit from concentrated effort on proven distribution rather than scattered presence across numerous smaller platforms. Once your channel achieves consistent viewership and stable technical operations, systematic expansion to additional platforms becomes feasible without overwhelming your team’s capacity.

Multi-Platform Technical Maintenance

Operating across multiple FAST platforms creates ongoing maintenance requirements that publishers consistently underestimate. Video encoding standards evolve, platforms update technical requirements, advertising integrations require periodic updates, and content policies change. Publishers must allocate permanent technical resources to platform maintenance—treating FAST distribution as “set it and forget it” inevitably leads to compliance issues and channel suspensions.

Centralising technical infrastructure simplifies multi-platform operations. Publishers should implement single encoding workflows that output platform-specific variants rather than maintaining separate encoding systems for each platform. Similarly, unified content management systems that push programming updates to all platforms simultaneously reduce administrative overhead whilst ensuring consistent viewer experiences.

Monitoring and analytics across platforms requires consolidated dashboards that aggregate performance data from multiple sources. Platform-native analytics provide detailed insights but create overwhelming complexity when managing 5+ distribution partners. Publishers should implement third-party analytics or build custom dashboards that track key metrics across all platforms in unified views, enabling strategic decisions based on comparative performance data.

Samsung, LG, and emerging platforms transform from optional distribution to strategic necessities as the FAST market matures. Publishers who master these platforms’ unique requirements while maintaining efficient multi-platform operations position themselves for sustained growth as streaming audiences fragment across expanding device and platform options.

Related news

View all